Rising commodities prices driven by the Russia-Ukraine crisis threaten to undermine Kenya’s economy, increase poverty

Related blog posts

Much of the early attention on the Russian-Ukraine conflict’s food security impacts has been concentrated on countries highly dependent on wheat imports from the Black Sea region. Given the important role that wheat products play in the diets of people in Egypt, Sudan, Yemen, Lebanon, and other countries, the interruption in Black Sea wheat trade and high prices have raised serious concerns about rising levels of food insecurity, poverty, and instability around the world.

But many countries are affected by price increases across a range of commodities (some predating the war) including in fertilizers, edible oils, and maize, as well as oil, natural gas and other energy products. How are these sharp international price increases impacting countries and people, and how can countries respond? Our recent modeling study focusing on Kenya suggests higher prices, particularly for fertilizer, will reduce GDP growth and increase poverty rates in the country, putting an estimated 1.4 million additional people below the poverty line.

Prices in Kenya are on the rise

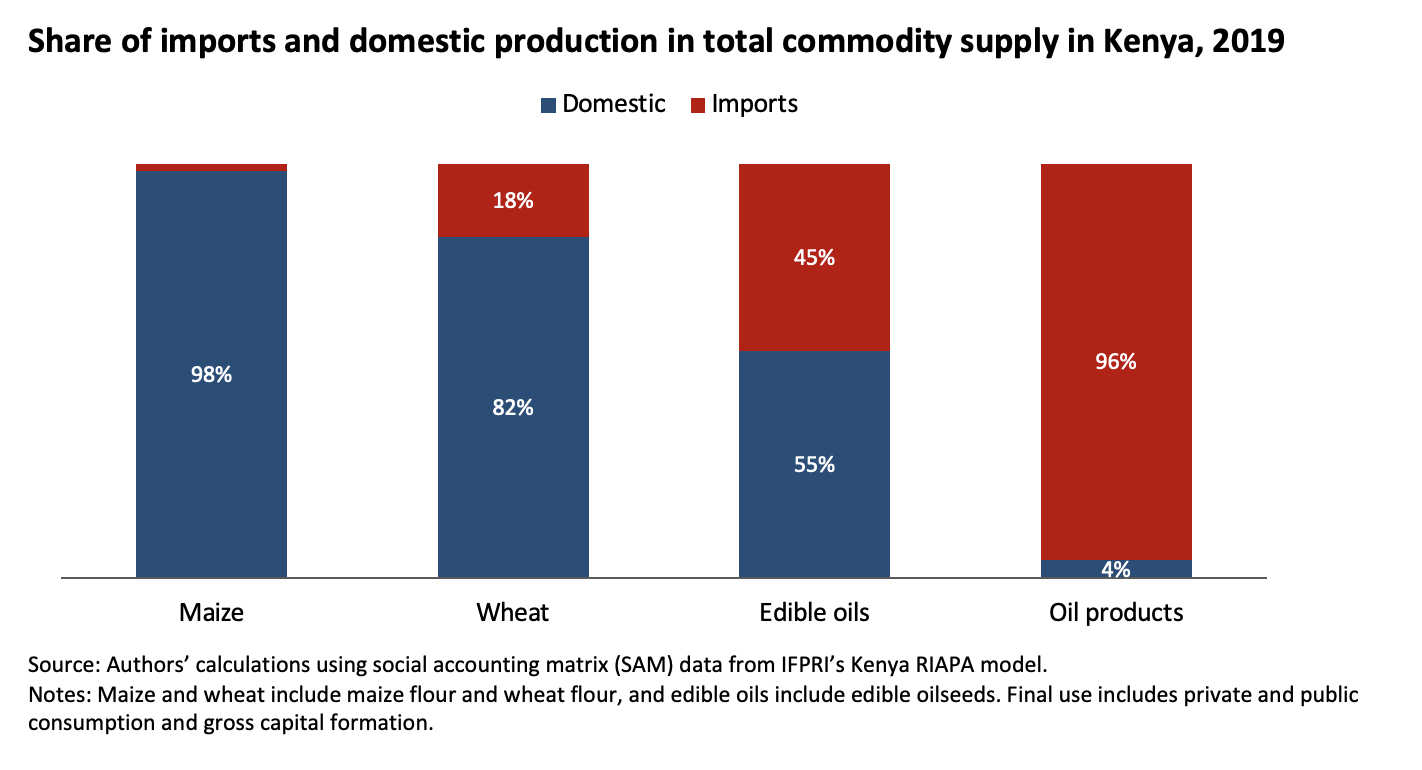

Inflation in Kenya hit 7.1% as of May 2022, mainly driven by a combination of high world commodity prices and a depreciating exchange rate (Central Bank of Kenya). The majority of maize, rice, and wheat in Kenya’s domestic market—including maize and wheat flours—are produced locally, while about 45% of edible oils are imported. Fuel and other petroleum products are almost all imported. Depending on the year, about 30%-50% of wheat grains processed in Kenya for final consumption or used for food processing industries come from Russia and Ukraine, and imported edible oils come mostly from Indonesia and Malaysia (UN COMTRADE database, 2022). While almost all chemical fertilizers are imported in Kenya, a relatively small portion come from Russia—about 9.3% of the total value of imported fertilizers in 2021 (UN COMTRADE). Kenya’s petroleum product imports come mainly from the Middle East.

Figure 1

Rising prices negatively affect Kenya’s economy and poverty

Almost all the commodities affected by recent global crises are consumed directly by households and used for other sectors’ production as intermediate inputs. Using IFPRI’s economy-wide Rural Investment and Policy Analysis (RIAPA) model for Kenya, we assess the likely impacts of the ongoing global crises on the Kenyan economy and people by taking into consideration cross-sector linkages and impacts on various supply chains.

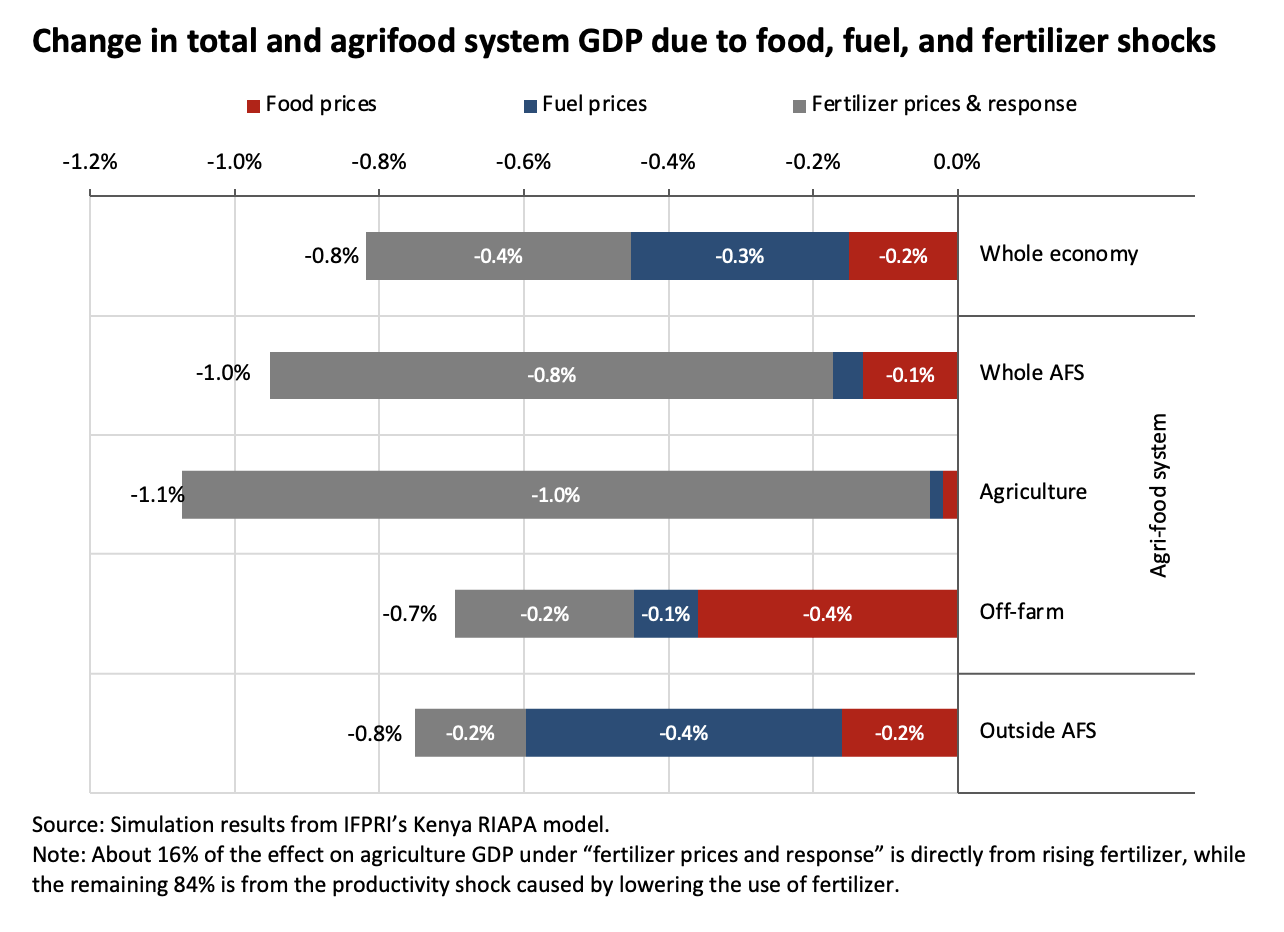

The study indicates that Kenya’s gross domestic product (GDP) could be 0.8% lower in 2022 compared to a situation without the global commodity price crises. More than 50% of GDP losses are from agriculture, driven primarily by higher fertilizer prices and the associated negative productivity effect from farmers’ reduced use (Figure 2). (The study assumes that a 100% increase in real fertilizer prices leads to a 15% decline in fertilizer use and that farmers who do not use chemical fertilizers are about 20% less productive than farmers who use chemical fertilizers.)

Figure 2

Household consumption is also negatively affected by rising world prices—particularly higher fuel prices that raise market prices for many consumer goods and services. The decline in consumption is larger for households towards the lower end of the income distribution, leading to increased inequality and greater poverty.

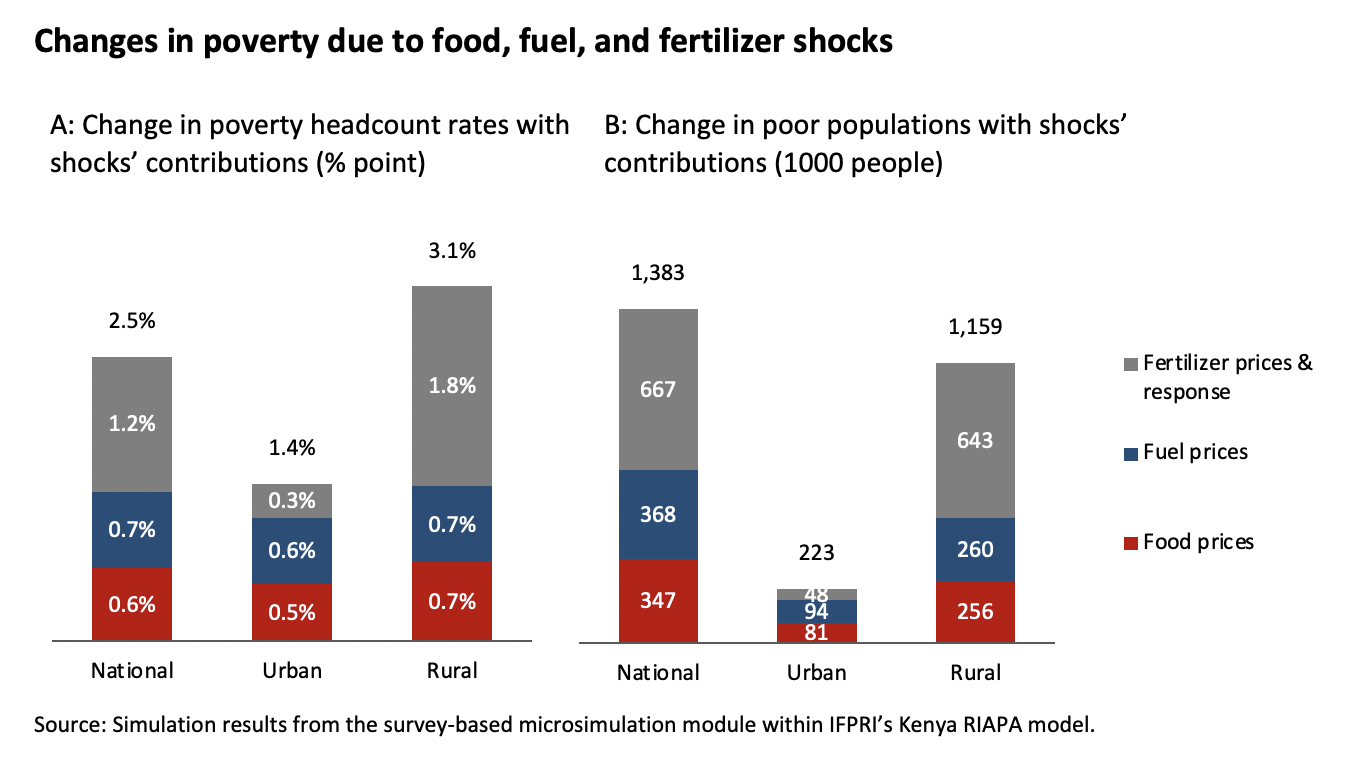

According to the most recent Kenya Integrated Household Survey Report (KNBS, 2018), the overall poverty headcount rate was 36.1%, with a rural poverty rate of 40.1% and core urban rate of 29.4%, respectively, in 2016. (The poverty line is defined as individual expenditures of less than $31.90 per month in rural and peri-urban areas, and less than $58.80 in core urban areas).

The increase in world prices raises the national poverty headcount rate in Kenya by 2.5 percentage points, while the rural poverty rate rises more, by 3.1 percentage points, vs. 1.4 percentage points for the urban poverty rate (Panel A in Figure 3)—this is equivalent to an additional 1.4 million people falling below the poverty line (Panel B in Figure 3). Most of the increase in poverty is caused by the fertilizer shock, and the absolute increase in the poor population is larger in rural areas, where more poor people are concentrated.

Figure 3

The Kenyan government responds with fertilizer and fuel subsidies

To cushion consumers and producers from the impacts rising global prices, Kenya’s government has implemented several fiscal measures, including fertilizer and fuel subsidies. As of April 2022, the government had budgeted a total of KSh.5.7 billion ($49.6 million) to subsidize 114,000 metric tons of fertilizer for crops. As the planting season was already ongoing, anecdotal evidence suggests that farmers largely made their planting and fertilizer adoption decisions before the subsidy mechanism was fully implemented.

The government introduced price controls in the energy sector in 2011, and in 2020 established a stabilization fund that became operational in April 2021. By April 2022, the government had already paid KSh.49.2 billion ($425.8 million) to oil marketers to keep the fuel prices in the country at a reasonable margin. With persistently high oil prices, the current fund is expected to fall short in maintaining fuel prices at pre-Ukraine war levels.

Policy options

In the short run, fertilizer and fuel subsidies can partially blunt the effects of global shocks on Kenya’s producers and consumers. Given that global fertilizer prices will likely remain high, due to fiscal constraints more targeted fertilizer subsidy schemes may be necessary before the next planting season. Maintaining the timely availability of fertilizers is also important.

However, going forward Kenya will need to expand its domestic fertilizer production to reduce its dependence on imports. The government has pursued this strategy, by allowing the private sector to import fertilizers and blend in the country for specific crops. The government should also consider encouraging the private sector investments to establish fully-fledged fertilizer production in Kenya and/or the broader East African region.

Given the impacts of the current crisis on the poor, social safety nets should be temporarily expanded, including existing cash transfer programs such as Orphans and Vulnerable Children (OVC) cash transfers, Persons with Severe Disability (PWSD) cash transfers, the Hunger Safety Net Program, and nutrition-sensitive cash transfers. The efficiency of these programs can also be improved, including meeting challenging problems of late disbursement of funds and delays in targeting and enrollment of beneficiaries, among other issues.

The current global crisis underlines the longer-term urgency of moving towards a green economy transformation. Currently, 75% of Kenya’s electricity is generated from hydro, wind, solar, and geothermal energy sources, and there are significant opportunities to expand production and foster green growth in industry and services sectors.

Expanding agricultural production and productivity, meanwhile, will require an increase of public and private investments in agriculture, improvements in the business climate, and more effective implementation of agricultural and related investment projects under the government’s Vision 2030 and Big 4 Agenda.

Our study indicates that rising prices of key commodities sparked by the Russia-Ukraine war are stressing Kenya’s economy, with the poor bearing the brunt. A combination of short- and longer-term actions by the government, business, and international partners can help to cushion those impacts, and to strengthen the country’s economy against future shocks.

Clemens Breisinger is a Senior Research Fellow and Kenya Country Program Leader with IFPRI; Xinshen Diao is Deputy Director of IFPRI’s Development Strategy and Governance Division (DSGD); Paul Dorosh is DSGD Director; Juneweenex Mbuthia and Lensa Omune are DSGD Research Officers; Edwin Ombui Oseko is an officer with the Fertilizer Promotion Unit, Kenya Ministry of Agriculture, Livestock, Fisheries and Cooperatives; Angga Pradesha is a DSGD Senior Research Analyst; James Thurlow is a DSGD Senior Research Fellow. This post is based on research that is not yet peer reviewed. Opinions expressed are those of the authors.

This post is drawn from a recent study conducted by IFPRI with financial support from the Bill & Melinda Gates Foundation (BGMF), the UK Foreign, Commonwealth & Development Office (FCDO), and the U.S. Agency for International Development (USAID). The study uses models developed with ongoing support from BMGF, USAID and the CGIAR Foresight and Metrics initiative.The study also benefited from collaboration with the CGIAR National Policies and Strategies (NPS) Initiative and IFPRI’s Kenya country program. Thanks to Joseph Karugia, ILRI, ONE CGIAR Country Convener for Kenya, for facilitating the NPS technical and the representatives from the Ministry of Agriculture, Livestock, Fisheries and Cooperatives, Kenya Agricultural and Livestock Research Organization, Tegemeo Institute, Kenya Institute for Public Policy Research, Egerton University, and private sector representatives and other stakeholders for attending this NPS technical meeting and for their valuable inputs.