From risk to resilience: How strategic government partnerships can enhance access to insurance-linked credit for smallholders in Zambia

Smallholder farmers across the globe produce over a third of the world’s food supply, yet they receive a disproportionately small share of global climate finance. A 2020 report released by the UN’s International Fund for Agricultural Development (IFAD) and Climate Policy Initiative (CPI) shows that less than 2% of international climate finance, amounting to approximately $2 billion, was allocated to smallholder farmers in 2017/2018.

The financing gap is particularly alarming given that an estimated 500 million smallholder households are vulnerable to climate-related risks; rising temperatures, extreme heat, and higher rainfall volatility are negatively impacting crop production and livelihoods, while drought is becoming an increasingly damaging and widespread problem.

Although the use of improved technologies such as improved seeds and machinery provides an avenue to increased productivity and climate resilience, many smallholder farmers lack access to sufficient credit to purchase these inputs. Climate risks together with other factors such as a lack of collateral make smallholders a risky and expensive segment for private financial service providers.

At the same time, smallholder farmers are quite averse to financing due to the perceptions associated with borrowing risks, high collateral requirements, the fear of losing collateral, and high interest rates. The result is underdeveloped rural financial markets that subsequently create a cycle of low investments, and therein low productivity, hindering not only agricultural productivity but also economic growth and development.

The power of bundled solutions: Bundling credit with weather insurance

Bundling agricultural credit with agricultural insurance has emerged as a promising strategy to mitigate climate-related lending risks related to smallholders. Recent advances in satellite and digital technologies have enabled the development of affordable index-based agricultural insurance products that protect farmers from extreme weather events such as droughts and floods.

Bundling enables the transfer of climate-related lending risks to the insurance market. By doing so, the bundling mechanism protects both the smallholders and the financial service providers by providing a means to offtake/offset the climate risks that both parties could potentially face. By reducing climate risk exposure, this approach aims to de-risk financial service providers, incentivizing them to serve smallholders.

Reduced climate risk could also reduce credit default rates and reduce or even eliminate collateral requirements for agricultural loans, potentially enhancing the risk-bearing capacity of smallholder farmers and enhancing both their credit uptake and willingness to increase their farm-related investments.

Since 2017, IFPRI, which leads Work Package 1 of the CGIAR Research Initiative on Climate Resilience (ClimBeR), has partnered with various research organizations, and local and international service providers to develop and implement an insurance bundled credit product more popularly known as risk contingent credit (RCC). RCC is a linked financial product that embeds insurance protection within its structure, which, when triggered, offsets loan payments due to the lender. The triggering event is defined around the most significant climate risk (such as extreme drought or flood events), that is highly correlated with individual crop yields, such as the extreme drought that has devastated maize yields in Zambia, for example.

With RCC, farmers do not have to pay a premium up front. Instead, farmers obtain a loan that allows them to purchase improved farm inputs such as seeds, fertilizer, chemicals, and irrigation equipment, and when the embedded insurance mechanism is triggered, their repayment obligation is reduced. When the insurance is not triggered, they pay an extra premium making the contract actuarially fair for both parties.

RCC is more financially inclusive than conventional credit products because of its insurance component, which is a substitute for collateral, that allows marginalized smallholders, especially women farmers to not only access the credit market but also face a lower risk of falling into a credit-driven poverty trap. In addition, the product’s structure aligns the interests of diverse stakeholders, including research organizations, and local and international financial institutions to support the climate resilience and long-term farm productivity of smallholders.

Evidence from pilots in Kenya and Ethiopia indicates that farmers with access to RCC tend to demand more production credit and increase investments in both improved seeds and fertilizers.

Here are some RCC Farmer testimonials from maize and bean farmers in Kenya:

Casting a wider net: Expanding reach through scale and commercial sustainability

Developing business models that align the interests of smallholders and financial service providers is crucial to not only scale up insurance-linked credit products such as RCC but to also ensure commercial sustainability. Commercial sustainability requires that financial service providers can offer these products profitably without relying on government subsidies or donor support. This is ideally the legacy that ClimBeR—which has supported a substantial part of this area of work expects to leave in its wake—where such interventions are driven and sustained by local champions, governments, and stakeholders.

These products could potentially benefit millions of smallholders—the custodians of our food systems across the globe. However, several demand- and supply-side constraints hinder their widespread adoption and long-term viability. During the pilots and fieldwork, the financial service providers with whom the field team engaged illustrated challenges related to high transaction costs, large residual risks (such as pests and disease, and other perils not related to the index), and the lack of efficient distribution channels. Meanwhile, challenges on the demand side, include limited farmer awareness and understanding, limited financial literacy, lack of trust, affordability issues, and discrepancies in individual losses and the amounts of payouts issued.

Forging partnerships to build a legacy of resilience

Scaling up RCC and achieving commercial sustainability requires innovative solutions such as, for example, strategic partnerships with existing government financing initiatives for smallholders. Targeted collaborative approaches such as this not only address these challenges but also unlock the full potential of insurance-linked credit products that help smallholders cope with the ever-increasing threat of climate variability and its impact on their livelihoods.

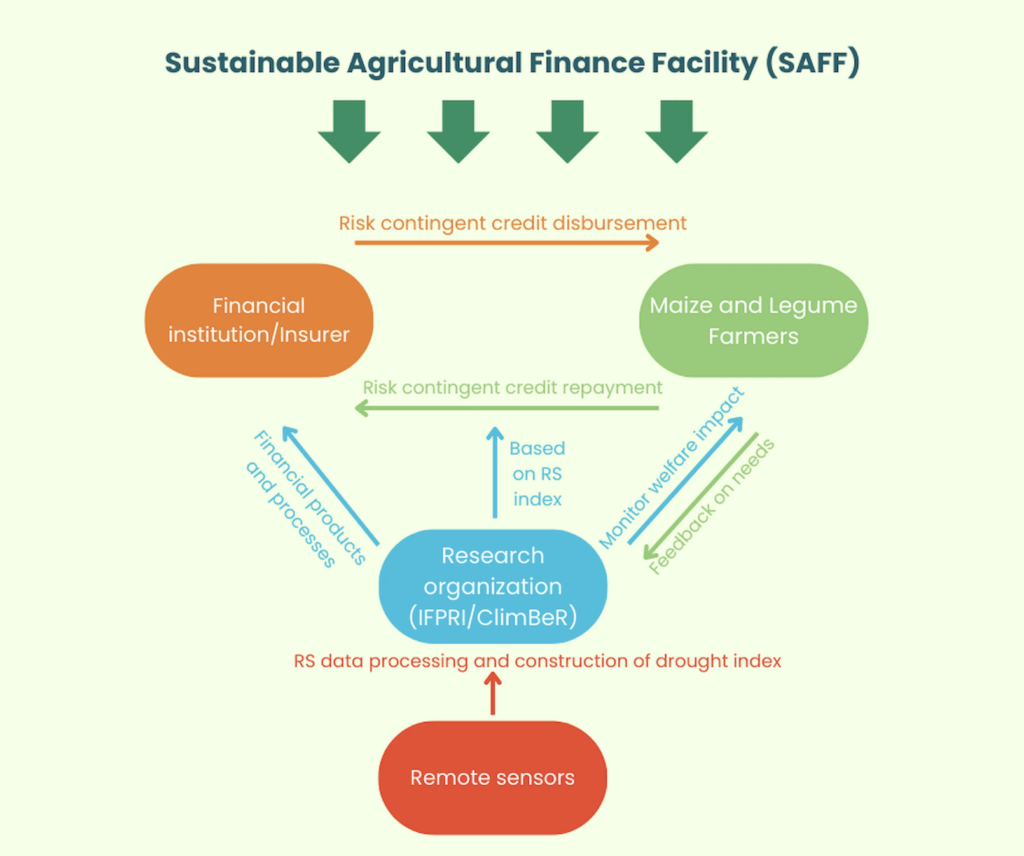

Such collaborative solutions require cultivating trust and identifying strategic partnerships—as can be seen by the partnership between IFPRI, its partners in this area of work, and Zambia’s Ministry of Agriculture. In August 2024, an agreement was put in place by these key actors to offer RCC under the government’s Sustainable Agricultural Finance Facility (SAFF) for the 2024 production period. SAFF is currently being implemented through the Zambian government’s Comprehensive Agriculture Support Program (CASP). It aims to increase agricultural productivity while enhancing resilience to climatic shocks through the development of sustainable climate financing approaches supported by the private and public sectors.

This strategic partnership is expected to enhance RCC’s scalability and commercial viability via different pathways. These include (i) leveraging SAFF’s established infrastructure and network to reach a larger pool of smallholder farmers, significantly reducing transaction costs for financial service providers, and improving smallholders’ trust in the product (ii) using SAFF’s extensive data on smallholder farmers’ financial behaviors and agricultural practices to improve RCC design (for instance reducing basis risk), pricing and support the tailoring of RCC products to local contexts (such as considering crop types), thereby increasing their relevance and appeal to farmers (iii) increasing RCC affordability and uptake through government subsidies or other types of financial support, and (iv) leveraging the government network to incorporate financial literacy and insurance education into existing farmer training programs to address the lack of product awareness and understanding.

ClimBeR expects to reach 2 million farmers in Zambia by June 2025 through the implementation of this partnership. The success of these types of interventions could also potentially attract blended finance, combining public and private capital to not only support RCC scaling but also commercial sustainability, thereby not only reaching a wider group of smallholders but also enhancing their climate resilience through the presence of and access to bundled insurance mechanisms that derisk smallholders, especially those most vulnerable.

Access to insurance-linked credit is an unconventional yet critical pathway to smallholder resilience and strengthening partnerships with varying levels of government is key to its long-term viability and sustainability.

Figure 1: RCC-SAFF business model

ClimBeR: Science in Action

Thank you for reading! Learn more about ClimBeR and how we work toward building smallholder resilience here.

Martina Mascarenhas is ClimBeR Communications Lead; Anne G. Timu is an Associate Research Fellow with IFPRI’s Foresight and Policy Modeling (FPM) Unit; Liangzhi You is an FPM Senior Research Fellow. Opinions are the authors’. This post first appeared on the ClimBeR blog.

The authors thank all contributors to the CGIAR Trust Fund for their invaluable support of these vital climate resilience initiatives, which enables us to carry out the work that we do towards building smallholder resilience that is both equitable and sustainable.