Parts of Southern Africa have been experiencing a severe drought since late 2023, fueled in large part by the ongoing El Niño Southern Oscillation. Falling harvests have led to disaster declarations in Malawi, Zambia, and Zimbabwe and affected countries across the region. In particular, maize yields have fallen sharply, threatening food security for millions of households depending on this key staple for a significant share of total calories consumed on a daily basis (Figure 1).

There are some positive signs, however: This post explores factors that may mitigate the drought’s food security impacts going forward, including large stocks following above trend harvests in the two previous years, and prospects for more favorable weather in the upcoming crop year.

Figure 1

El Nino's impact on rainfall and crop conditions in Southern Africa

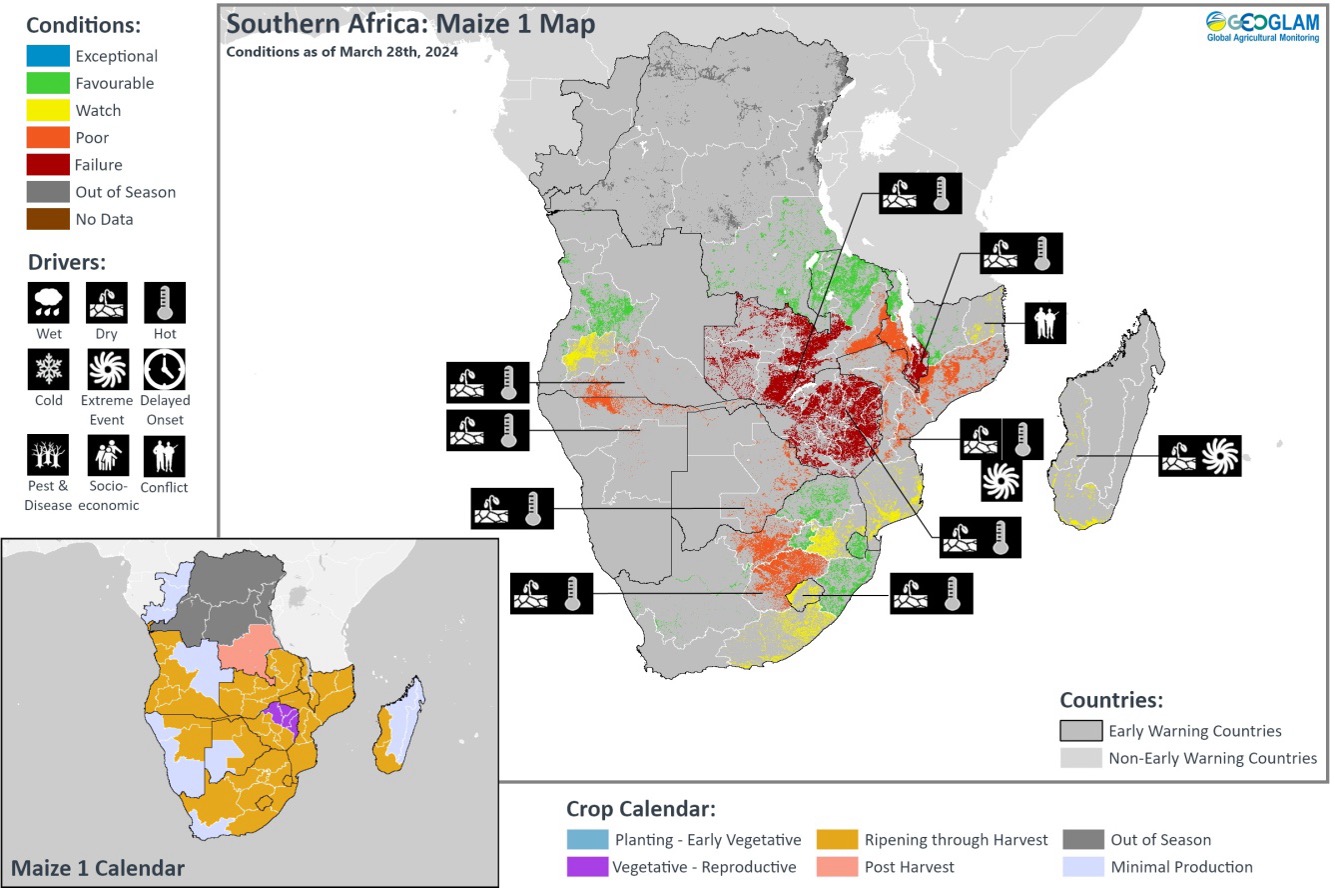

The lack of rainfall in late January through mid-March has desiccated soils, led to anomalously high daytime temperatures, and damaged crops throughout Southern Africa. February and March were among the driest months on record (since 1981) in much of Zimbabwe, Zambia, and parts of Angola, Botswana, Lesotho, Malawi, and Mozambique. The dry spell has lasted over 30 days in many areas and comes at a critical time for crop growth, leading to reports of permanent wilting of crops in Malawi, Zambia, and Zimbabwe (Figure 2). Because the vast majority of maize in the region is rainfed, timely and adequate rainfall is critical for crop development.

Figure 2

Source: Crop Monitor for Early Warning report No. 92 (April 4, 2024)

Source: Crop Monitor for Early Warning report No. 92 (April 4, 2024)

The ongoing 2023/2024 drought is an expected, if intense, manifestation of typical, interrelated El Niño effects throughout the region. During El Niño years, the probability of drought increases significantly across Zimbabwe, southern Zambia, southern Mozambique, southern Malawi, and South Africa. The potential for the 2023/2024 El Niño to lead to drought and heat that damages crop yields in the region was noted in an August 2023 special report by the Group on Earth Observations Global Agricultural Monitoring Initiative (GEOGLAM). At the start of the rainfall season in November, the U.S. National Oceanic and Atmospheric Administration (NOAA) forecast a drought for December-February, which the Famine Early Warning Systems Network (FEWS NET) used to highlight the potential for lower than normal labor opportunities and below normal harvests. These effects are now unfolding, with FEWS NET estimating that deficit-producing areas are facing Crisis (IPC Phase 3) levels of food insecurity in Zimbabwe, Malawi, central Mozambique, and Madagascar.

The ongoing drought has been widespread, yet less intense in the major production regions of South Africa and southern Malawi. South Africa maize yields will be 17% below expected levels, according recent production estimates from the U.S. Department of Agriculture (USDA). While significant, these yield reductions are on the moderate end of what is expected during strong (>2C) El Niño events (Figure 3).

Figure 3

Impact on Southern Africa production

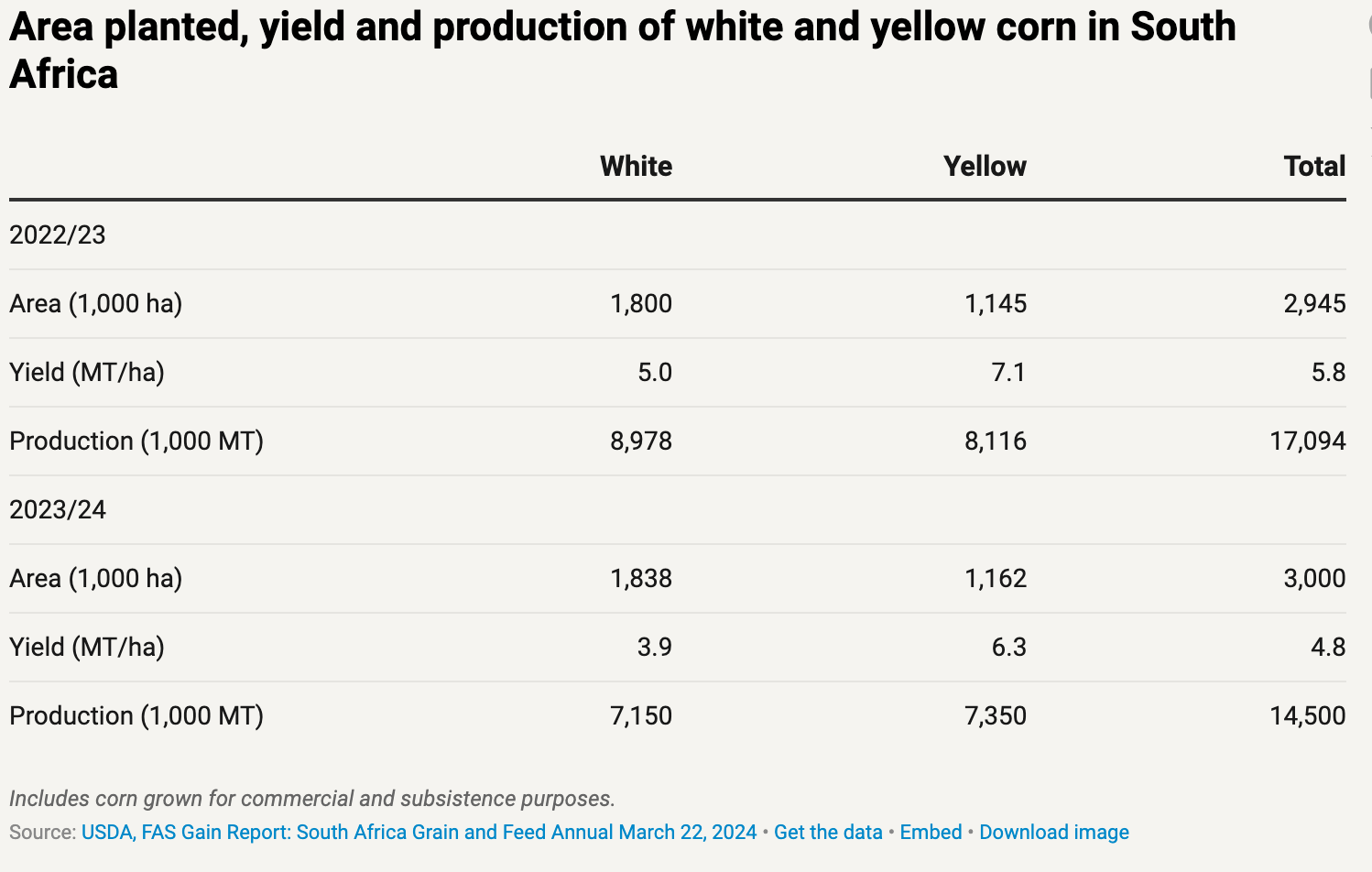

The USDA’s South Africa post estimates that the country’s maize production for 2023/24 to be 14.5 million metric tons (MT), a decline of 15% from 2022/23 levels (Table 1). (A 2% increase in planted area helped to offset the 17% decline in yields). Yellow maize production, primarily used for animal consumption, is estimated to decline by 9.4%, while white maize production, primarily used for human consumption, is expected to decline by 20%.

South Africa accounts for 70% of Southern Africa maize production. USDA first crop yield estimates for rest of the region will not be released until May 10, but preliminary estimates suggest that many of the region’s high producing areas have been affected by the dry weather conditions.

Table 1

An important mitigating factor is that the current harvest follows two years of above average yields due to favorable growing conditions during the past La Niña event. USDA estimates that carryin stocks (that is, those left over at the end of the previous marketing year) for 2023/24 are 2.5 million MT—the highest level since the 2018/19 marketing year. As a result, combined maize supplies (carryin plus production) are down only 10% from the preceding marketing year (Figure 4).

Figure 4

South Africa typically holds 65%-70% of the region’s stocks, with Zambia holding about 25%. USDA's estimates of Zambia maize beginning stocks are estimated at 513,000 MT, up 10% over last year, but almost 1 million tons less than stock levels of 2 years ago.

Impact on exports

South Africa is the major maize exporter in the region, accounting for 88% of total exports. The country mainly exports white maize to its regional customers in Southern Africa and yellow maize to markets in Asia. During previous droughts, South Africa has largely exported to its regional markets (Figure 5). During the first two months of 2024, almost 98% of total South Africa maize exports went to countries in Southern Africa.

Figure 5

USDA estimates that South Africa exports will likely fall 44.4% in 2023/24 (to 2.0 million MT). A key question now is whether those exports will be enough to satisfy the needs of other countries in Southern Africa, or whether importing countries like Zimbabwe will need to seek alternatives from outside the region as well. In recent months, Zimbabwe has been a major recipient of South Africa maize, importing over 244,000 MT in January and February alone (Figure 6). In July 2023, Tanzania imposed export restrictions that reduced maize exports in the second half of the year by 60% compared to the same period in 2022. In the past, Argentina and Mexico have exported white maize to the region, but Mexico's current supplies are low due to restrictions placed on imports of U.S. white maize and reduced domestic production due to drought.

Figure 6

Impact on prices

Maize and maize meal prices (Table 2) have moderated in South Africa, Botswana, Eswatini, and Namibia, while inflationary pressures in Lesotho, Mozambique, and Zambia have kept prices of both commodities high. Zimbabwe's macroeconomic difficulties have resulted in triple digit inflation, food items included.

Table 2

Looking forward

Unlike 2014 to 2016, when key producer-exporter South Africa suffered back-to-back droughts, this year's drought follows a year of good harvest and stock building. Larger beginning stocks will help buffer the impact of the current drought. However, supplies from outside the region be necessary to meet consumption needs, and exports will likely decline, particularly to markets outside of Southern Africa.

There may be no immediate relief on the horizon for maize crops this season, but next year will likely be a better growing season due to a developing La Niña, often associated with above normal precipitation and normal to above normal maize yields in Southern Africa. The March NOAA CPC/IRI ENSO forecast indicates that there is an 85% likelihood of La Niña conditions developing by October-December 2024. That may provide an opportunity to draw down available stocks to meet current consumption needs with the hopes of replenishing supplies in the upcoming crop season.

Joseph Glauber is a Senior Research Fellow with IFPRI's Markets, Trade, and Institutions Unit; Weston Anderson is an agroclimatologist at the University of Maryland and NASA, Earth Sciences Division. Opinions are the authors'.