Impacts of Red Sea shipping disruptions on global food security

The recent attacks of Yemen-based Houthi rebels on ships in the Red Sea have paralyzed shipping through the Suez Canal, forcing exporters in the Black Sea region and elsewhere to consider alternative—and more costly—shipping routes. In early January, A.P. Moller-Maersk A/S, the world's second-largest container ship company, announced it would suspend shipments through the Red Sea. Trade volumes in the Suez Canal are down an estimated 40% since the attacks began.

Such choke point disruptions to global shipping, while rare, have recently cropped up in diverse locations. In March 2021, the Suez Canal was blocked for six days when the one of the world's largest container ships, the Ever Given, became wedged in the southern portion of the canal, causing a worldwide trade disruption. More recently, drought has reduced water flows in the Panama Canal, severing limiting shipping and raising costs. Last summer and fall, droughts affected water flows in the Rhine and Mississippi Rivers, adversely affecting shipping on major inland waterways.

The current crisis is disrupting shipments of grains and other key commodities from Europe, Russia, and Ukraine. This can raise the costs of imported products for consumers and lower prices paid to producers—posing risks to already precarious food security in some countries, particularly those dependent on food imports. This post examines the impacts of the Red Sea disruption on key exporters and for food commodity markets and consumers in East Africa and Asia.

Impacts of transportation costs on food prices

Increased transportation costs have several economically disruptive impacts. They raise consumer costs and reduce demand, which in turn means lower prices for producers in exporting countries. They also lower trade volumes, resulting in higher price volatility, as it is more costly to import goods when prices are high or to export goods when prices are low. Suppliers dependent on disrupted trade routes can see their competitiveness erode as importers seek alternative suppliers to secure lower prices.

Transportation costs have already been quite volatile over the past four years. After initially falling during the first year of the COVID-19 pandemic, they began rising as the global economic recovery stimulated demand and raised energy prices. As trade exploded, resulting in shortages of shipping vessels and congestion at major shipping ports, transportation costs rose further. Between May 2020 and October 2021, shipping costs for grains and oilseeds, as measured by the International Grain Council's Grain and Oilseed Freight Index, rose over 250% (Figure 1). Then the upward trend reversed. With bunker oil prices falling through much of the second half of 2022 and first half of 2023, shipping costs fell as well, and while prices have rebounded over the past six months, they still remain significantly below their peaks in late 2021 and early 2022.

Figure 1

Potential impacts of the Red Sea disruptions on wheat exports

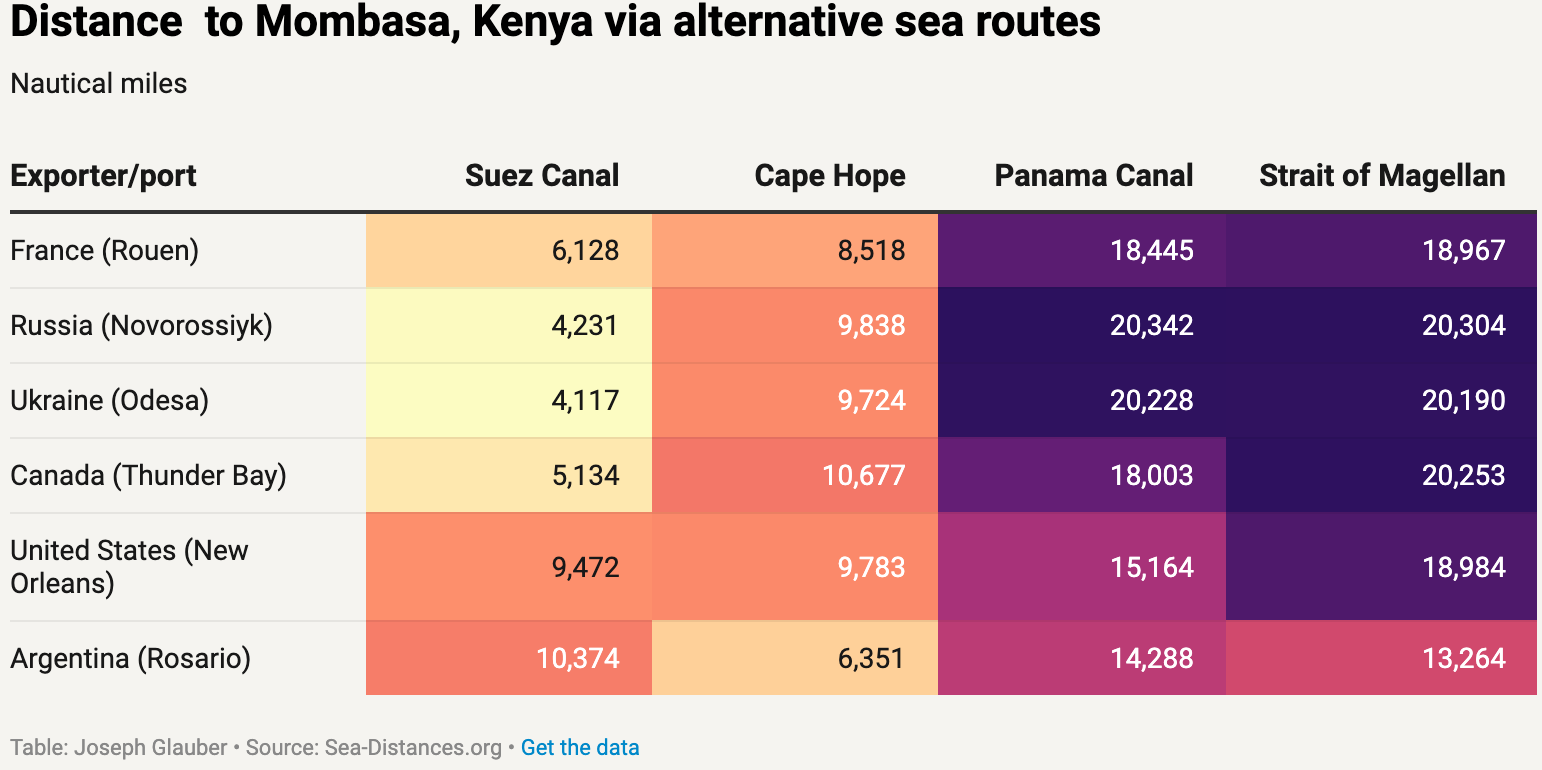

Using 2018-2020 data, a Chatham House analysis concluded that about 14% of cereals and 4.5% of soybeans traded globally pass through the Suez Canal. However, for certain exporting countries the share is far greater. Table 1 shows the average shipping distances to Mombasa, Kenya (in nautical miles) for various wheat exporters. For wheat originating from the European Union, Russia, and Ukraine, shipping through the Suez Canal is the shortest route to Mombasa, while alternative routes are typically far longer; traveling around Cape Horn is as much as twice the distance or more (Table 1).

Table 1

For example, for Russian wheat originating from the Black Sea port of Novorossiysk, shipping by way of Cape Horn instead of the Suez Canal increases the distance by 5,607 nautical miles. Assuming a ship speed of 12 knots, that would more than double the voyage time from 14.7 days to 34.2—driving the costs of fuel and ship operations up substantially. This in turn increases the landed costs of Russian grain in Mombasa (with some of the additional shipping costs absorbed by Russian exporters). If such disruptions persist, Kenyan importers may choose to switch to alternative suppliers such as Australia or Argentina whose exports do not face shipping disruptions.

Based on real-time maritime cargo tracking data published by the World Trade Organization's Global Trade Data Portal, we can impute the share of wheat exports from the European Union, Russia, and Ukraine that has likely transited through the Suez Canal and Red Sea.1 Data since July 2020 indicates that roughly 20%-30% of those wheat exports would be potentially affected if cargoes had to be redirected from the Suez Canal to longer routes around Cape Hope (Figure 2). The war in Ukraine has already had a negative impact on Ukraine wheat exports, reducing them overall and shifting them away from markets including sub-Saharan Africa and Southeast Asia.

Figure 2

Impact on importers

From a food security perspective, which countries are most likely to be affected by the current Red Sea crisis? As outlined in the analysis above, trade disruptions are most likely to impact the countries in East Africa, South Asia, Southeast Asia, and East Asia. Figure 3 shows the share of wheat imports from the EU, Russia, and Ukraine as a percent of total wheat imports in 2021 (the last year for which data on Russian exports was available).

Figure 3

The map shows countries in East Africa, Iran and Pakistan are particularly vulnerable to trade disruptions, due to their relatively high reliance on wheat imports from Europe and the Black Sea. In the case of East Africa, previous research has shown that for many of the countries, imports account for a large share of consumption. Disruptions to imports could put further pressure on food inflation in these countries, which has just begun to abate following consumer price increases in 2022.

As explained above, the analysis assumes that all wheat exports from the EU, Russia, and Ukraine to the regions shown transit through the Red Sea. This may overstate the impact on Russian exports for countries like Iran and China, where alternative albeit more expensive routes may be available (for example, via Caspian Sea ports in Iran or Pacific ports for China).

If the disruptions continue, consumers in importing countries will end up bearing some of the cost increases. Countries may choose to seek alternative suppliers, although El Niño related impacts have reduced wheat production in Australia, another major supplier to the region.

Closure of the Red Sea also would have a detrimental impact on Ukraine maize exports to China (Figure 4). China has accounted for about 20% of Ukraine's maize exports since 2018 and was an important destination under the now-discontinued Black Sea Grain Initiative (BSGI), which allowed passage of shipments from ports in the war-torn region. Long-term disruptions to Red Sea shipping would further harm on Ukraine’s competitiveness, already suffering because of the war and July 2023 termination of the BSGI.

Increased shipping costs would also affect China, as Ukraine had a become a significant supplier of maize to China over the past five years, averaging about 30% of the country’s total maize imports since 2020 (Figure 4). Increased costs of sourcing Ukraine maize would likely push China to increase imports from the United States and Brazil, which has become a major supplier since maize imports from Brazil were approved in late 2022.

Figure 4

Conclusions

The scale of impacts of the Red Sea crisis on shipping, markets, and food security will depend on how long the Houthi attacks continue. While the conflict affects only a small share of overall agricultural trade, a long-term disruption will have clear impacts on some economically vulnerable importing countries in Africa and Asia, forcing them to seek alternative suppliers or pay significantly higher costs to import. If those markets switch suppliers, producers in Europe, Russia, and Ukraine will then likely see lower prices over the longer run. While this worst-case scenario for the Red Sea crisis is still unlikely, the current disruption is a reminder of the fragility of supply chains and the need for countries to be flexible in sourcing food when disruptions occur.

Joseph Glauber is a Senior Research Fellow with IFPRI's Markets, Trade, and Institutions (MTI) Unit; Abdullah Mamun is an MTI Senior Research Analyst. Opinions are the authors'.

1. It is assumed that all maritime wheat exports from the EU, Russia and Ukraine to East Africa, East Asia, South Asia and Southeast Asia ships through the Suez Canal. The list of countries and the general methodology of the WTO trade shipment tracker can be found here.