How is Kenya’s National Fertilizer Subsidy Program working?

- Kenya

- Eastern Africa

- Fertilizer

- Input Markets

- Agricultural Inputs

- Agricultural Production

- Agricultural productivity

- Food Crisis and Related Risk Factors

Related blog posts

The Kenyan National Fertilizer Subsidy Program (NFSP), implemented during the short rainy season in September 2022, has emerged as a pivotal policy in the government’s efforts to expand food production and mitigate soaring food prices.

The program offers subsidized fertilizer at half the price of commercial fertilizer to anyone. With a subsidy outlay of 3.55 billion shillings ($23 million), the program is intended to bolster Kenya’s agricultural sector and help to stabilize food prices. According to the Ministry of Agriculture and Livestock Development (MoALD), about 3.5 million 50 kilogram (kg) bags of subsidized fertilizer had been distributed in 41 of the country’s 47 counties from the inception of the NFSP through July 30, 2023.

Fertilizer subsidy programs can certainly reduce the costs of agricultural production, and thus also contribute to lower food prices. But many other factors impact both agricultural productivity and food prices—from fuel prices to global market dynamics. How is NFSP working so far, and what other obstacles do the government face in addressing these challenges—particularly the rising cost of living, which has direct ramifications for the nutrition and well-being of both rural and urban populations?

To address those questions, a team of experts from the CGIAR Initiative on National Policies and Strategies conducted a rapid assessment of the NFSP in the context of the broader economic landscape affecting agricultural productivity and food prices. We utilized various datasets from sources including the Kenya Agricultural Market Information System (KAMIS), World Bank Pink Sheet data, the Energy and Petroleum Regulatory Authority (EPRA) and the National Treasury and Economic Planning. Information from expert interviews from the MoALD and from six last-mile service providers involved in input provision, mechanization and aggregation in Nyanduara and Nakuru counties was also used to supplement the analysis.

The rapid assessment yielded several key insights.

First, Kenyan smallholders’ adoption of modern agricultural technologies, including fertilizers, has remained persistently low for decades. The government of Kenya started an initial wave of fertilizer subsidies in 2007 through the National Accelerated Agricultural Input Access Programme (NAAIAP). From 1992-2013, the percentage of maize farmers using fertilizer ranged from 62% to 65% (Jena et al., 2021). The adoption rate also varied significantly depending on farm size. Between 1997 and 2007, the average fertilizer usage among smallholder farmers with landholdings of less than 1 acre was 63.15%, while usage on farms exceeding 3 acres was 75.4% (Olwande et al., 2009).

This limited adoption of fertilizers (and other technologies, such as improved seeds) contributes to the country’s consistently low average agricultural yields. From 1992-2013, maize yield decreased from 1,360 kg/hectare (ha) to 1,116 kg/ha. Recent data also indicates a decline in maize production from 42.1 million bags in 2020 to 36.7 million bags in 2021, and further dropping to 34.3 million bags in 2022. (The most common weight for a bag of maize in Kenya is 90 kg.)

Thus, the NFSP faces significant obstacles in reaching farmers who may not have experience with fertilizers. The assessment raises doubts about whether subsidized fertilizers are accessible to such farmers. Unlike previous fertilizer subsidy schemes in Kenya, the current program is not targeted.

Second, farmers familiar with fertilizers are not embracing the subsidized offering. The assessment found that the nutrient composition of the subsidized fertilizer had a significant impact on the adoption rate. Farmers favored unsubsidized diammonium phosphate (DAP) over the subsidized nitrogen-phosphorus-potassium (NPK) fertilizers, which contain only half the amount of phosphorus found in DAP. The government’s reason for excluding DAP from the subsidy program is because of a widespread soil acidity problem attributed to long-term use of DAP on farms without periodic application of lime.

Third, switching from the previous voucher-based system to distributing subsidized fertilizer through the National Cereals and Produce Board (NCPB) has incurred transaction costs (farmers queue in long lines to receive the subsidized fertilizer) and might have discouraged smallholder farmers from obtaining subsidized fertilizer. By distributing subsidized fertilizer at a lower cost than that offered by private sector input dealers, there is also a risk of crowding out the private sector.

The previous system was paperless. Farmers received e-vouchers via phone that they could redeem at agro-dealer outlets near them. But the program had limitations. When the government switched to distributing subsidized fertilizer through the NCPB in 2022, it cited two main problems with e-vouchers: The system had limited publicity, making it unsuitable for utilizing its infrastructure to supply subsidized fertilizer countywide; and the e-vouchers had initially been implemented as a pilot phase, and the platform still lacked the capacity to manage all farmers.

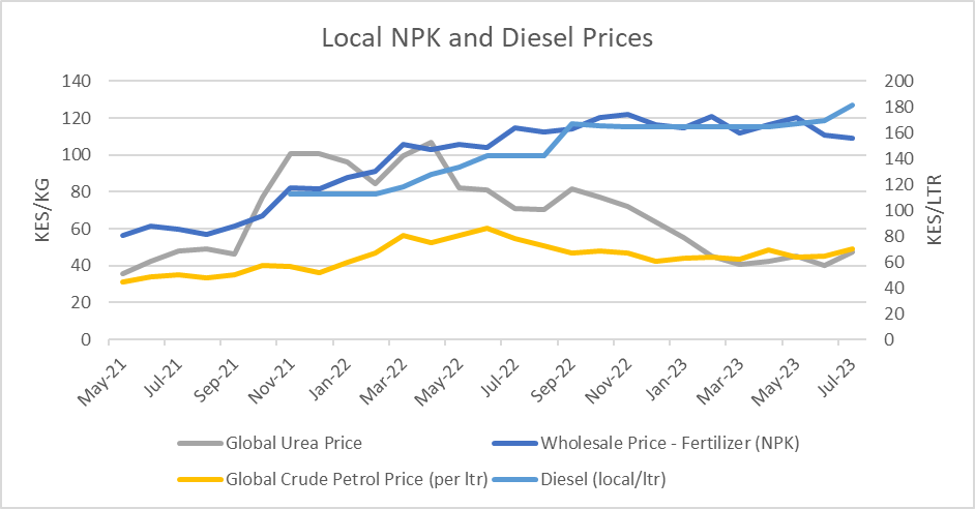

The assessment also indicates that fertilizer prices in Kenya exhibit inertia, which could be attributed to an increase in tax rates and the depreciation of the Kenyan shilling against the U.S. dollar. Figure 1 presents the trends of fertilizer and fuel prices between May 2021 and July 2023. It shows that, as global prices for urea and crude petrol fell or remained relatively flat from 2022 through July 2023, the domestic prices of NPK and diesel fuel rose and then remained high. This is likely contributing to higher food prices.

Figure 1

Correlation between global and local diesel and fertilizer prices. Source: KAMIS, EPRA and World Bank Pink Sheet data.

Correlation between global and local diesel and fertilizer prices. Source: KAMIS, EPRA and World Bank Pink Sheet data.

Other factors have also contributed to high prices of basic commodities—mainly maize—including rising transport costs, input costs, labor costs and supply chain disruptions, and a fuel tax increase. A July 2023 tax change eliminated a provision that halved the value added tax (VAT) on all petroleum products to 8%. The doubled rate of 16% raised fuel prices at the pump. The retail price of white maize increased by 43.9% between 2021-2022 and 2023, according to KAMIS data.

Overall, the rapid assessment suggests that the rising costs of other inputs such as fuel have likely offset the potential positive effects of fertilizer subsidies and recent favorable weather. This, in turn, suggests potential impacts on food security, as higher food prices combined with stagnating or declining real incomes can negatively impact dietary diversity and nutrition (Kenya Food Security Simulator).

This complex interplay of economic factors indicates that the modalities and impacts of fertilizer subsidies should not be assessed in isolation, but considered along with other factors affecting agricultural productivity and food prices.

What can be done to alleviate some of these economic pressures in the context of fertilizer policies? Abandoning the e-voucher program has created some problems, the assessment shows. Vouchers and other market-based approaches can improve accessibility, take-up rate of fertilizer and avoid crowding out the private sector. Improving agricultural extension services—especially enhancing soil testing facilities and making them more affordable for farmers—can help optimize fertilizer use and improve agricultural productivity.

Policymakers should also find ways to address other factors that are a drag on Kenya’s agricultural economy, impacting agricultural productivity and food prices. Transportation fuels stand out as a primary factor, and the assessment points to the advisability of implementing a more gradual approach to changing fuel taxation levels, allowing consumers and producers more time to adjust.

Hailemariam Ayalew is a Research Fellow with IFPRI's Development Strategies and Governance (DSG) Unit, based in Nairobi; Joseph Karugia is a Principal Scientist with the International Livestock Research Institute (ILRI), John Olwande is a Research Fellow with the Tegemeo Institute of Agricultural Policy and Development; Clemens Breisinger is a Senior Research Fellow and IFPRI Kenya Country Program Leader. This post first appeared on Agrilinks. It is based on research that is not yet peer-reviewed.

ChatGPT was used to support the authors in summarizing the report: “Fertilizer Subsidies and Tax Reform in Kenya—What Are the Impacts on Food Prices? A Rapid and Preliminary Expert Assessment.”

The experts who participated in this policy paper include Clemens Breisinger, Hailemariam Ayalew, Joseph Karugia, Kibrom Abay, Michael Keenan, Hugo De Groote, John Olwande, Lensa Omune, Esther Waruingi and Christine Mwangi.